Renovation Loans: Your Secret Weapon in the Short-Term Rental Arena 🏗️🏠

The Game-Changer in STR Investments🎲 Cash is king, and so are renovation loans in the Short-Term Rental (STR) game. After all, high bookings mean having a well-maintained property that people want to vacation in, or (if a mid-term rental) want to live in for an extended period of time. This is even more true if…

Continue Reading Renovation Loans: Your Secret Weapon in the Short-Term Rental Arena 🏗️🏠

Navigating the World of Property Appraisal: A DiggifiGuide 🏠🔎

Most real estate investments depend on getting a good appraisal – as does the financing that makes the acquisition even possible. This is definitely the case in the Short-Term Rental (STR) world, in order to maximize your Loan-to-Value. The appraisal determines whether you get the valuation (and, thus, the loan proceeds) that you need to…

Continue Reading Navigating the World of Property Appraisal: A DiggifiGuide 🏠🔎

Cash-Out Refinancing: How to Make the Most of Your STR Investments 🏡💰

You real estate investments are hopefully going to rise in value – and that creates this magical tool called “equity”. This increase in equity is an asset you may want to tap into, particularly with cash-generating Short-Term Rentals (STRs). There are two primary ways to free up that equity: Either sell your properties or go…

Continue Reading Cash-Out Refinancing: How to Make the Most of Your STR Investments 🏡💰

DSCR Loans for Short-Term Rentals: Unraveling the Secrets 🏠💼

Understanding DSCR—Debt Service Coverage Ratio—is key to leveraging your property’s earning potential and securing the right financing. In this post, our aim is to provide clear, practical insights for investors looking to navigate to the best debt in the short-term rental market. A blatant plug!: Diggifi does DSCR loans, for STRs and other investor-owned housing!…

Continue Reading DSCR Loans for Short-Term Rentals: Unraveling the Secrets 🏠💼

5 Terms of Short-Term Rental Loans You Must Know🏡

Navigating the world of short-term rental (STR) loans can be complex, but understanding these top five terms can make a significant difference in your investment strategy. Let’s break them down: Warning – self-promotion alert!: Diggifi does STR loans and one of our loan consultants will be only-too-happy to analyse these loan terms with you on…

Continue Reading 5 Terms of Short-Term Rental Loans You Must Know🏡

Why Financing a Short-Term Rental with a Loan Beats All-Cash Purchases🏡

Your ROI in Short-Term Rental (STR) deals will pivot around one core decision, in common with all real estate transactions: The choice between using all-cash, or taking out a loan for such investments. A lot of STR investors lean into using their own cash and savings (or that of their friends & fam) – but…

Continue Reading Why Financing a Short-Term Rental with a Loan Beats All-Cash Purchases🏡

🌟 How to Acquire New Short-Term Rental Properties: A Diggifi Guide 🏡

In the world of short-term rental property acquisitions, the only thing more exciting than finding a great property to buy – is not overpaying for it. Here’s a lighthearted guide to help you navigate this profitable journey: 1️⃣. Identify Your Target Market 🎯💹 Location Exploration: Discover areas bustling with tourists or business travelers. Property Selection:…

Continue Reading 🌟 How to Acquire New Short-Term Rental Properties: A Diggifi Guide 🏡

Navigating Airbnb Financing Challenges During Storms

In the land of real estate investment, financial storms make for rough waters. They beg for the life-preserver of strong financing solutions . All owners feel this rising pressure, but one sector loves sun above all: AirBnb and other short-term rental (STR) investors. If that’s you, how can you weather this storm? As we all…

Continue Reading Navigating Airbnb Financing Challenges During Storms

Cubicles-for-Couches – Investing in Properties that are perfect for Work-from-Home

Remote work, also known as “work-from-home” or WFH, is a seismic shift that’s rocking the housing market. As more people trade cubicles for couches, housing preferences are changing dramatically. How can savvy investors adapt and prosper?😎 Dialing into the Data: The Demand Shift COVID-19 didn’t just disrupt our lives; it rewired our work culture. According…

Continue Reading Cubicles-for-Couches – Investing in Properties that are perfect for Work-from-Home

Charging Ahead: Getting loans the EV Impact on Multi-Family Properties

To shift gears from our regularly-scheduled program of real estate-related articles, we want to turn our proverbial headlights onto an electrifying topic – the integration of Electric Vehicle (EV) charging stations in multi-family residential properties. As our roads vroom into the future, let’s explore the specific challenges and opportunities this powerful trend presents. Journey to…

Continue Reading Charging Ahead: Getting loans the EV Impact on Multi-Family Properties

Bridge Loans and Gap Financing: The Secret Weapons of Savvy Real Estate Investors in Today’s Market

Construction loans, Credit, finance, Fix and flip, Foreclosures, Hard money loans, Mortgage, Real Estate Investing / By diggifi Hello, real estate enthusiasts! In the ever-evolving landscape of real estate investing, timing is everything. And in today’s volatile RE market, having the right financial tools at your disposal can make all the difference. Enter bridge loans and gap financing. What are Bridge Loans and Gap…

Another Bank Bites the Dust

One can almost hear the pounding beat of Queen’s masterwork– “Da da da da da….Another bank bites the dust…” Pounding is the right description – as that’s what the banking world and the real estate world are now taking. First Republic is the latest domino to fall. What the heck is going on — and…

Are Mortgages About to Disappear?

What is that loud “sucking sound”? That deafening WHOOSH? That is the sound of credit being sucked out of the economy… and watch out to make sure that you are not sucked out along with it. Real estate markets are about to see their tide flow out….and then, to paraphrase the famous Warren Buffet, some…

Real estate investors, what happens if your lender goes bankrupt?

As we are writing this post, it is early morning the week of March 20, 2023 – and tension is mounting. First Republic Bank is poised at an incredibly sensitive moment, Signature Bank has seen its branches absorbed by NYCB Flagstar Bank, Credit Suisse was just bought by its Swiss counterpart UBS….and who knows what’s…

Continue Reading Real estate investors, what happens if your lender goes bankrupt?

As banks keep crashing down, real estate deals pop up!

The noise of banks crashing down is enough to make your head spin….and what’s a poor real estate investor to do amidst all this craziness? Keep in mind, it’s not only the banks in the headlines that are hurting – even those banks not (yet) shut down are under tremendous pressure from their regulators to…

Continue Reading As banks keep crashing down, real estate deals pop up!

The banks are collapsing, can I still get a loan?

Top 5 things for real estate investors to know about the Silicon Valley Bank collapse Silicon Valley Bank and its collapse might sound like it has nothing to do with the real estate investor, but boy does it! And don’t even get us started on Signature Bank. We provide our Top 5 tips about how…

Continue Reading The banks are collapsing, can I still get a loan?

How to Get a Lien Waiver

A lien waiver is like a magical piece of paper that says, “Don’t worry, I’ve been paid!” As a real estate investor, especially one who’s into fix and flip, obtaining a lien waiver is crucial to make sure that you’re protected from any future financial demands from those who have worked on your property. And…

Top 5 Things to Know About House Flipping

Top 5 Things to Know About House Flipping House flipping has become a popular real estate investment strategy in recent years, with many real estate investors attracted to the potential for quick profits and the excitement of transforming a property into a valuable asset. However, flipping a house is not as easy as it may…

Depreciation in Real Estate Investments

Doesn’t real estate only go up?? Depreciation in real estate investments Wealth creation is the draw for the majority of residential real estate investors. However, there are different strategies for achieving that wealth. House flippers are focused on turning a profit as quickly as possible and moving on to the next project. Conversely, investors who…

Top 5 Things to Know About Construction Drawdowns

Borrower beware! Construction loans are a critical part of many real estate investments, but they can really get you! This is especially true around construction drawdowns, a standard part of these loans. For anyone involved in a project with a construction component, we discuss the top 5 things to know about construction drawdowns that can…

Continue Reading Top 5 Things to Know About Construction Drawdowns

Private Lenders for Real Estate Investments

Ferrari Vs Camry, why you should be using private lenders for real estate investments Real estate investing can be a great way to build wealth, but it often requires a significant amount of capital to get started. One of the most common ways to finance a real estate investment is through a mortgage, just like…

Continue Reading Private Lenders for Real Estate Investments

Mechanic’s Liens in Real Estate Investing

How to Avoid Mechanic’s Liens in Your Projects As a residential real estate investor, it’s important to consider all the potential pitfalls before making your next big deal. One potential roadblock is the mechanic’s lien. Imagine the horror of closing on your dream house flipping project, only to be hit with a mechanic’s lien that…

Tax Treatment of House Flippers

Now that year-end is behind us, we’ve got taxes on our mind, specifically, the tax treatment of house flippers. “If you’re paying taxes, that means you’re making money” – so goes the old adage and it is true. But, while true, nobody wants to pay Uncle Sam more than they need to…and some clever tax-planning…

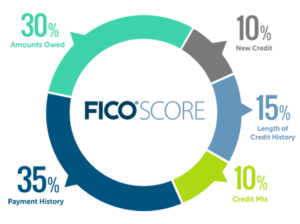

Diggifi Tips: FICO Scores for real estate investors

FICO Scores for real estate investors….why are they so important? Beginner real estate investors and fix and flippers…and sometimes experienced investors often ask: “I’m a professional real estate investor…why does my FICO score still matter for this flip?” Let’s DIG in a little bit… Why are Fico scores so essential for real estate investors and…

Continue Reading Diggifi Tips: FICO Scores for real estate investors

Detailed Explainer – Real Estate Financing for Your Fix and Flip

Introduction Today, fix-and-flip loans have become essential for house flippers that need startup capital without a lot of strings attached. Whether you want to start a dedicated house-flipping business or earn money on the side, you don’t need a top-tier bank account. From experienced and reputable real estate investors to new property-flipping businesses, several loan…

Continue Reading Detailed Explainer – Real Estate Financing for Your Fix and Flip

Foreclosures and Short Sales, What’s the Difference?

There is no such thing as a free lunch. If you are a fix and flipper planning to find a deal with enough juice to buy it, fix it, and flip it for a profit, you better buy it right. There may be no better way to score a below-market price on your fix and…

Continue Reading Foreclosures and Short Sales, What’s the Difference?