FICO Scores for real estate investors….why are they so important?

Beginner real estate investors and fix and flippers…and sometimes experienced investors often ask:

“I’m a professional real estate investor…why does my FICO score still matter for this flip?”

Let’s DIG in a little bit…

Why are Fico scores so essential for real estate investors and fix and flippers?

Well, it’s important because when a borrower applies for a loan, a lender needs an objective, quick, and easy way to qualify or disqualify a borrower right off the bat. This isn’t to say it’s the only criteria (far from it), but often it’s a simple way to decide whether to keep DIGGING in or to pass before wasting too much time. On the FLIP side, a good FICO score is a huge advantage for a borrower. It will give them easier access to capital, better terms, and oftentimes a lower rate. It will also keep the process moving quickly, which is essential in hard money lending or fix and flip financing. A low FICO score means that all of the other elements of the deal and the individual borrower just need to be that much more impressive.

Ok that all makes sense, but what does FICO even stand for? It’s actually not so exciting, but it refers to the Fair Isaac Corporation, which created the FICO score to establish an objective industry standard that both lenders and borrowers could use.

OK OK, you know that a FICO score has something to do with your credit, but what exactly?

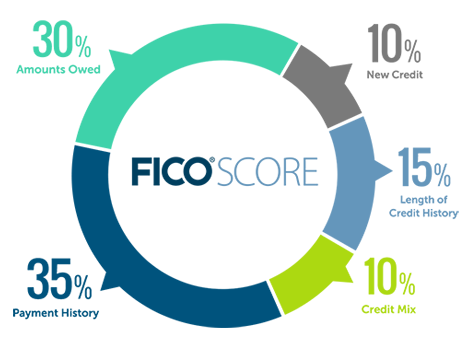

A FICO score is basically an overview of your credit score. It takes into account multiple factors such as, how much credit you currently have, how much you are using right now, when you began accumulating credit, and do you actually pay off your credit on time.

Why does this matter for real estate investors?

When applying for a loan, and definitely a hard money loan, especially for an individual, one of the first things the lender checks is the borrower’s FICO score. Lenders will put extra emphasis on the FICO score of first time or inexperienced investors and flippers. Generally speaking, a 620 score is considered to be the low end of the scale for an acceptable score, and of course, the higher the better. Whether a borrower is looking for a loan for a fix and flip, ground up construction, a buy and hold, a BRRRR or just about anything, they can make it a lot easier on themselves when they manage their credit responsibly.

Last question…if I am a business entity and not buying as an individual, does my FICO score still matter? If you are an established real estate investor or have experience flipping, a lender could very well look at your business credit score as well.

Check back next time for more tips, and download Diggifi at www.diggifi.com to get started on your project today!